Individual Coverage Health Reimbursement Arrangements (ICHRAs) give employers a level of flexibility that traditional group health plans can’t match.

ICHRAs are still tax-advantaged group health benefits. But how employers fund them — through defined contributions — is entirely different. It’s what makes them such a cost-controlled, customizable, and compelling option.

As a broker, you play a key role in helping clients understand how defined contributions work. This guide gives you what you need to support smarter decisions around defined contribution strategies, affordability, and how platforms like Nexben’s can help you implement them.

From percentage-based to defined contributions

With a traditional group health plan, employers decide what percentage of the premium they’ll cover. For example, an employer might offer three plan options and agree to pay 70% of the premium for each. Employees pick a plan and cover the remaining 30%.

With ICHRAs, percentages no longer apply. Instead, employers offer a set monthly dollar amount, called a defined contribution, to up to 11 different employee classes. Employees then use that contribution to buy the individual coverage that best fits their needs.

What each employee owes beyond the contribution depends on the policy they choose.

For some employers, moving away from percentage-based contributions may feel unfamiliar. But it’s also what unlocks the control and flexibility that make ICHRAs so compelling. Employers set their total health benefit budget and then decide who gets a contribution (based on employee class) and how much each class (and their dependents, if applicable) will receive.

So, how do you help your clients build a smart defined contribution strategy that checks important affordability boxes? Here’s a three-step process you can walk them through.

Step 1: Determine who’s eligible by employee class

Employers can choose who’s eligible for the ICHRA (and for a defined contribution) using the following 11 employee classes:

- Full-time employees

- Part-time employees

- Seasonal employees

- Salaried employees

- Non-salaried employees (such as hourly)

- Employees covered by a particular collective bargaining arrangement (different bargaining units can be separate classes)

- Employees who have not satisfied a waiting period

- Temporary employees of staffing firms

- Non-resident aliens with no US-based income

- Employees working in the same insurance rating area (geographic location, state, or region)

- Any combination of two or more of the above

This gives your clients the flexibility to offer tailored contribution amounts to different employee classes — helping them better match benefits to their workforce needs and budget. For some employers, it even creates an entirely new opportunity to offer health benefits to part-time or seasonal workers.

Step 2: Check affordability requirements

Before helping clients set defined contribution amounts, make sure to check if they’re subject to affordability requirements under the Affordable Care Act’s employer mandate. It’s also important to revisit the affordability calculation each year, as the percentage changes annually. (See below for the 2025 affordability calculation.)

The employer mandate requires Applicable Large Employers (ALEs), those with 50 or more full-time equivalent employees, to offer comprehensive and “affordable” health coverage to their full-time employees and dependent children. If they don’t, they may be subject to steep penalties called shared responsibility payments.

Here’s what to know:

1. Two penalties to avoid

- An ALE can avoid the first penalty by offering an ICHRA to at least 95% of its full-time employees (those working 30+ hours per week). If they fail to meet this requirement, they will be assessed a penalty for all eligible employees.

- An ALE can avoid the second penalty by ensuring the IRS considers the ICHRA it offers “affordable.” See the calculation below. If they fail to meet this requirement, they will be assessed a penalty for each employee who takes a subsidy to help them pay for their premium.

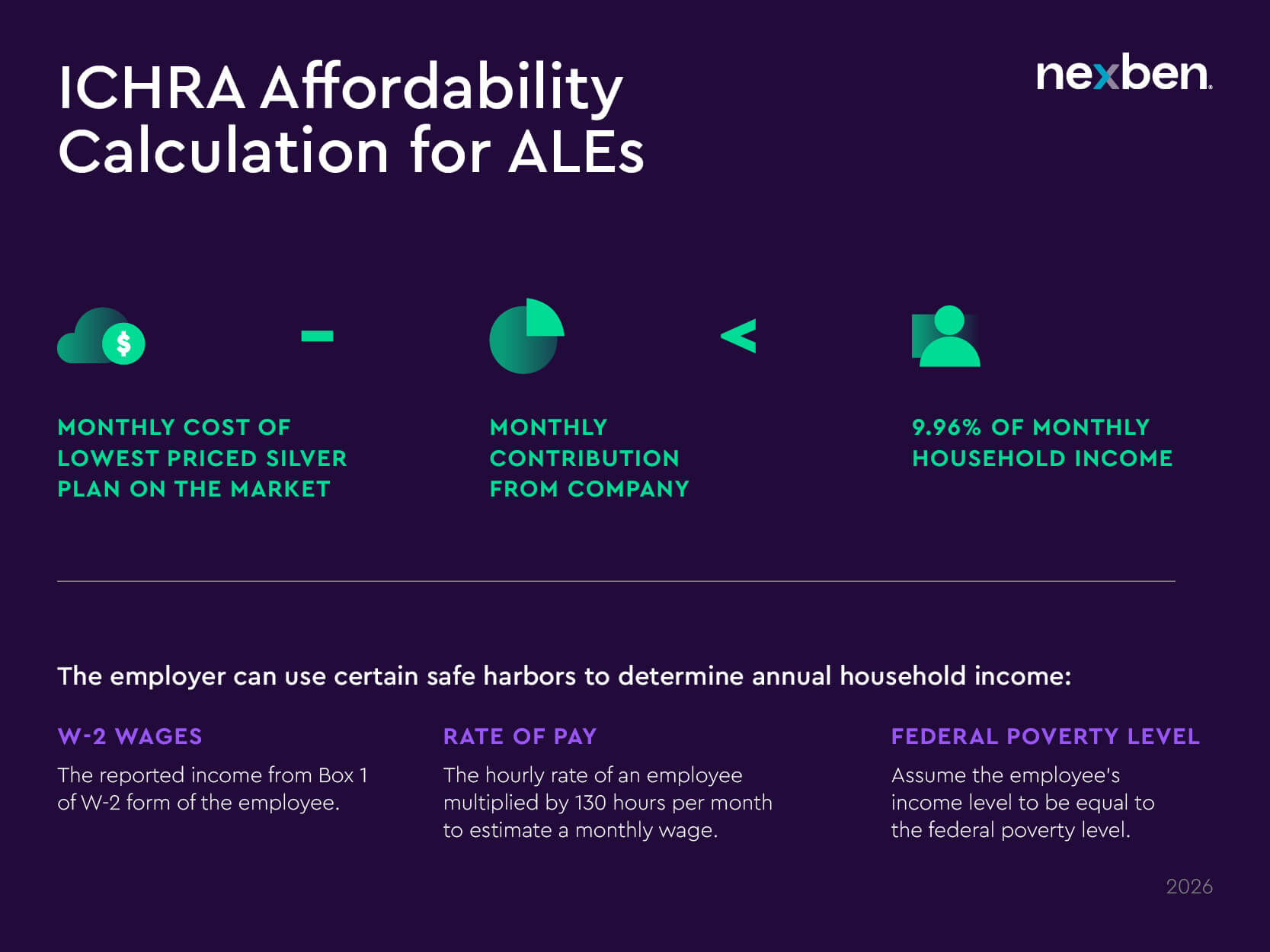

2. Affordability calculation

The IRS considers an ICHRA “affordable” if the monthly cost of the lowest-priced silver plan (self-only coverage in the employee’s area of residence) minus the employer’s monthly ICHRA contribution (not including any increased amount based on the number of covered dependents) is less than 9.96% of the employee’s monthly household income (for 2026).

3. Safe harbors to use in the calculation

Because employers often don’t know an employee’s household income, the IRS has three safe harbors to choose from when calculating affordability:

- W-2 wages: Based on Box 1 income on an employee’s W-2 form

- Rate of pay: Hourly wage × 130 hours/month

- Federal poverty line: Uses the federal poverty level as a stand-in for income

These safe harbors give you a reliable way to help clients assess affordability and avoid penalties.

Affordability Example

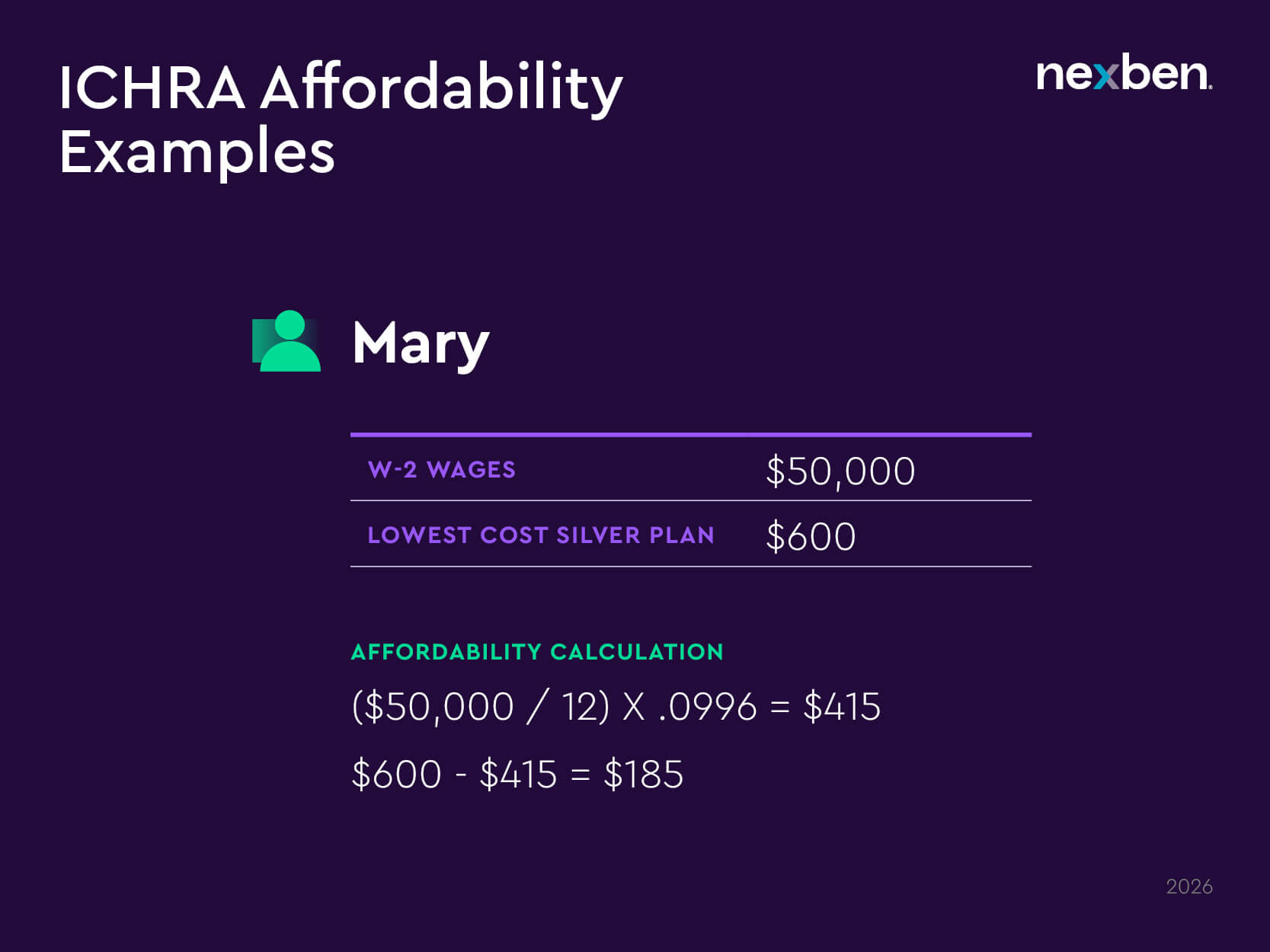

Let’s consider Mary as an example.

Mary makes $50,000 per year in W-2 wages. The lowest cost silver plan available to her is $600/month.

Here’s what the affordability calculation would look like for Mary:

($50,000 / 12) X .0996 = $415

$600 – $415 = $185

Mary’s employer must contribute at least $185 to her health insurance coverage for the IRS to consider it affordable.

You can use this same formula to help clients estimate what they need to contribute to avoid penalties.

Step 3: Choose the contribution approach

Once you’ve checked affordability and selected employee classes, it’s time to design the actual contribution strategy — how much, for whom, and in what structure.

Employee classes aren’t the only way employers can customize their defined contributions. They can also vary contribution amounts based on employee age and whether they are also offering a contribution to spouses and children.

Nexben supports the following three contribution approaches:

1. Employee-Only Contribution

This approach focuses on giving employees a flat dollar amount for their own coverage. Employers can offer:

- The same amount to all employees

- Age-based amounts

- Different amounts for different classes

Example A (Employee-Only):

All employees receive $350 per month.

Example B (Employee-Only):

Contributions vary by age band:

| Age Band | Monthly Contribution |

| 0-30 | $200 |

| 31-40 | $300 |

| 41-50 | $400 |

| 51-60 | $500 |

| 61+ | $600 |

Important: ICHRA rules require no more than a 3:1 ratio between the highest and lowest contribution by age.

Example C (Employee Only):

Employers can contribute different contributions to as many of the 11 employee classes as they’d like. In this example, the employer is using the employee classes to contribute to its full-time, part-time, and seasonal employees:

| Employee Class | Monthly Contribution |

| Full-time employees | $500 |

| Part-time employees | $250 |

| Seasonal employees | $250 |

2. Tiered Contribution

In this approach, employers set fixed dollar amounts based on coverage tiers that vary based on whether the employee covers just themselves or adds family members. The employer gives equal amounts to all employees, regardless of age.

Example (Tiered):

| Tier | Monthly Contribution |

| Employee | $500 |

| Employee + Child | $550 |

| Employee + Spouse | $600 |

| Employee + Children | $700 |

| Family | $800 |

Note: The contribution amounts for each tier are shared among all members of that tier and don’t reflect contributions for each individual.

3. Contribution by Relationship

This option allows employers to assign individual contribution amounts to each member in the household: employee, spouse, and child(ren). Here, contributions can vary by relationship, age and relationship, and by employee classes.

Example A (Relationship):

| Relationship | Monthly Contribution |

| Employee | $500 |

| Spouse | $300 |

| Child | $100 (per child) |

Example B (Relationship):

| Monthly Contribution | |||

| Age Band | Employee | Spouse | Child |

| 0-30 | $200 | $100 | $100 per child |

| 31-40 | $300 | $150 | $100 per child |

| 41-50 | $400 | $200 | $100 per child |

| 51-60 | $500 | $250 | $100 per child |

| 61+ | $600 | $300 | $100 per child |

Important: ICHRA rules require no more than a 3:1 ratio between the highest and lowest contribution by age.

Help clients make smart, flexible contribution decisions

Defined contribution health plans — offered through ICHRAs — give your clients more control, clarity, and customization than traditional group plans. But they also require a new way of thinking about how contributions are set, who receives them, and what’s considered affordable.

As a broker, this is where you shine. By understanding the rules and strategy options, you can guide your clients toward smarter decisions that support their teams and protect their budgets.

And with the Nexben platform, you’ve got the tools to support every contribution strategy, no matter how simple or complex.

Ready to help your clients rethink what health benefits can be? Let’s talk. We’ll show you how Nexben’s ICHRA solution supports contribution strategies that work for every kind of workforce.

About Nexben

Nexben is a financial technology company that makes defined contribution health benefits simple, seamless, and powerful. Connect with us to learn how partnering with Nexben can help you deliver smarter, more cost-controlled solutions to your clients.